"How do you advance climate measures without negative social feedback unwinding the whole proposition?"

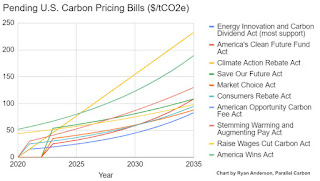

A flurry of carbon pricing bills await the US Congress when it returns from vacation next month. Fifteen now pending are supported by Democrats and 5 of those are also supported by Republicans.

With 79 co-sponsors, the Energy Innovation and Carbon Dividend Act ($15/tC from 2021 rising 10%/y+inflation) is the most broadly supported carbon pricing bill in Congress at the moment. Its economy-wide price on carbon would push for net zero by 2050. Ninety percent of USAnians would receive a dividend that would more than offset the higher prices caused by the fees.

America’s Clean Future Fund Act ($25/tC from 2023 rising 10%/y+inflation) also includes an economy-wide carbon price with 75 percent of revenue returned to households as dividends and the rest invested in clean energy and transition assistance to state and local governments.

The Climate Action Rebate Act ($15/tC from 2021 rising $15/y+inflation) has a high price trajectory with 70% of revenue returned to households as dividends and the remainder invested in infrastructure, research and development, and transition assistance.

The Save Our Future Act pairs a carbon price ($54/tC from 2023 rising 6%/y) with a price on other air pollutants. The money from the fee goes as direct payments to US citizens, investments in frontline impact fossil fuel communities, and block grants to states.

The Market Choice Act ($35/tC from 2023 rising 5% + inflation) is a bipartisan infrastructure bill with a modest carbon price that rebates to fund climate adaptation.

The Consumers Rebate Act ($25/tC from 2021 rising 10%/y) offers 0.5 to 1 percentage point reduction in individual income tax rates (four lowest brackets only) and after block grants divides 80 percent for “quarterly citizen rebates.”

The Consumers Rebate Act ($25/tC from 2021 rising 10%/y) offers 0.5 to 1 percentage point reduction in individual income tax rates (four lowest brackets only) and after block grants divides 80 percent for “quarterly citizen rebates.”

The American Opportunity Carbon Fee Act ($52/tC from 2020 rising 6% + inflation) would give tax credits, Social Security beneficiary payments, and $10 billion in block grants.

The Stemming Warming and Augmenting Pay Act ($30/tC from 2021 rising 5% + inflation + $3/y) would give 70 percent in payroll tax cuts.

The Raise Wages Cut Carbon Act ($44/tC from 2020 rising 2.5% + inflation) and America Wins Act ($52/tC from 2020 rising 6% + inflation) would only apply to energy sector emissions.

The Healthy Climate and Family Security Act would auction GHG pollution permits and send 100 percent of revenues in quarterly dividends to most legal residents, equally.

Under all of these bills there are more winners than losers. The vast majority of taxpayers would receive more money than climate solutions will cost them.The wildfire driving these bills, more than the actual, bipartisan, fires in Western States, may be the incipient trade war. EU and China are planning to extend taxes or carbon fees to Scope 2 (supplier energy use) and Scope 3 (customer) emissions for their domestic companies.

This is going to seriously degrade US exports if the Congress fails to enact its own fee system first. The Save Our Future Act imposes an “Equivalency Fee” on energy-intensive manufactured goods (5% energy cost minimum) but reduces it if the importing partner country imposes “carbon-based fees.” The Market Choice Act imposes a trade tariff based on GHG intensity of the manufacturing sector. The America Wins Act subsidizes fossil fuel and “carbon-intensive goods” exports to counter foreign tariffs and puts a tariff on C-intense imports. The Energy Innovation and Carbon Dividend Act and the America’s Clean Future Fund Act make border adjustments for iron, steel, aluminum, cement, glass, pulp, paper, chemicals, and ceramics. While export of fossil fuels would be exempt by the Consumers Rebate Act, a “Carbon Equivalency Fee” would be imposed on “imports of goods containing or produced” using fossil fuels but would exempt trade partners with equivalent measures.

In my first installment of this series I went back to a 1992 paper by W.D. Nordhaus that plunged headlong into the mire of carbon taxation. In Nordhaus’s optimization path, a carbon tax of $5 per ton from 1990, gradually rising to $20 by 2100 would hold Earth to 1.5C above 1900 levels. Later revisions of his “Dynamic Integrated Climate-Economy,” or DICE — put the social cost of carbon at about $88 per ton by 2050. The Obama administration’s estimates pegged the sweet spot at $50 a ton, but the Trump administration cut the estimate to as little as $1. Biden estimates roughly match Obama’s, coming in at $51.

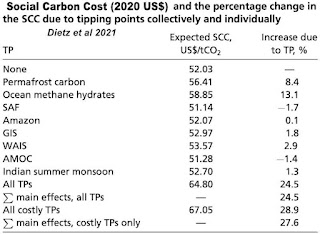

In a Nature paper published July 27, Daniel Bressler updated Nordhaus’ DICE model for the social cost of carbon to $258 per ton and another paper scheduled for publication August 24 in PNAS puts the Social Cost of CO2 (SCC) at 24.5% greater when tipping points are incorporated rather than ignored. It is important to note, however, that 25% is just the median estimate, with 50% confidence. The paper’s high-end estimate is 347.8% higher social costs when factoring tipping points like melting permafrost and the slowing Atlantic Current. I described last week how we currently spend more than $1600 per ton paying polluters to pollute. It would seem to me the price to un-pollute the same CO2 should at least equal that.

In a Nature paper published July 27, Daniel Bressler updated Nordhaus’ DICE model for the social cost of carbon to $258 per ton and another paper scheduled for publication August 24 in PNAS puts the Social Cost of CO2 (SCC) at 24.5% greater when tipping points are incorporated rather than ignored. It is important to note, however, that 25% is just the median estimate, with 50% confidence. The paper’s high-end estimate is 347.8% higher social costs when factoring tipping points like melting permafrost and the slowing Atlantic Current. I described last week how we currently spend more than $1600 per ton paying polluters to pollute. It would seem to me the price to un-pollute the same CO2 should at least equal that.

What it means is, there’s a small-but-not-negligible chance that we are currently underestimating the cost of carbon emissions by as much as 250 percent or more. If that is true, we’re really giving bad policy advice, as in, “market mechanisms” vs. “wartime footing.”

My own thought exercises in this area go back to the 1980s when I was litigating climate change in court. In that process I interviewed a number of climate scientists who had been ruminating along these lines. I wanted to tease out some of their ideas when I was working on my book, Climate in Crisis, but by 1989 when I sent the final manuscript to the publisher, most proposals for carbon exchanges were still too poorly formed to include. Rather than publish some hazy ideas then emerging from Irish peak-oilers or an obscure K-Street think tank called Global Commons Institute, I decided, with editors Matthew McClure, Rachel Sythe and Barbara Wallace, to limit the discussion to two subchapters in my chapter called “Twenty-One Better Ideas.” Sub 13 was “Establish World Targets:”

The United States has the means to reduce its energy costs by $220 billion per year, above and beyond the $150 already saved by recent improvements. The price for this cost reduction would be an investment of only $50 billion, meaning that the investment could be completely paid off in just 83 days.

The world could have a 2 percent annual rate of efficiency improvement for the next decade without having to come up with any new technology — we already know how to do it. To sustain a 2 percent improvement rate beyond the year 2000 will require a little more effort and innovation, but that effort, estimated to cost $15 billion, would reduce energy consumption to one-third of present levels over a 50-year period.

Some countries have been achieving this 2-percent target for the past 15 years. The technology is steadily improving. We can make buildings all over the world as efficient as they are in Sweden, industrial factories as efficient as they are in Japan, and automobiles as efficient as the best French and German prototypes, with very little additional capital outlay, and with a rapid pay-back from reduced energy overhead. Why don’t we do it? Up until now, we haven’t considered it all that important.

Sub 14 was “Tax Greenhouse Gases:”

The moment we put a dollar per ton tax on the emission of carbon dioxide, we will see a change in the rate at which industries discharge carbon. It may take a year or two, but everything that can be done to save that dollar, if it costs less than a dollar, will be done. When we reach that point we need to raise it to 2 dollars per ton. Then it needs to go to 3 dollars per ton. … [A] carbon tax of $50 per ton would raise the price of gasoline by seventeen cents per gallon and of electricity by 2 cents per kilowatt-hour. It would cost consumers some $240 per year in the United States and $9 in India. These are not insurmountable sums, especially if they were reached gradually, over the course of several years, And yet, a $50 tax on each ton of CO2 could raise nearly $300 billion annually, more than enough to offset the diverse economic impacts that may accompany the worldwide shift toward sustainability.

There is more in Climate in Crisis, and I recommend it if you can find a remaindered copy on EBay, but at this stage I want everyone to notice the $300 billion. Where does that go? How does it get to those people and companies who will be most harmed by the tax? One way would be to make it an actual tax and let government dispense it. There are many perils in that approach, not the least being negative social feedback that could unwind the whole proposition — or “strangle the baby in the crib,” to use the anti-tax rhetoric of that period.

Contraction and Convergence

At the Global Commons Institute, the idea of putting these billions to social use and rebranding climate mitigation as a “tax” was batted around until they came up with the idea, c.1989, of “Contraction and Convergence.” Their notion was to reduce overall emissions of greenhouse gases to a safe level (contraction) by leveling emissions per capita to an equal degree for all countries (convergence). The burdens of carbon taxing would fall mainly on the wealthy and profligate consumer countries, which would incentivize rapid decarbonization. C&C proposed to dispense the billions in tax revenues to bring up standards of living in the poorer two-thirds world, a sustainable development “dividend.” The UN formally adopted a version of C&C in the run-up to Kyoto (COP-3) in 1997.

At the Global Commons Institute, the idea of putting these billions to social use and rebranding climate mitigation as a “tax” was batted around until they came up with the idea, c.1989, of “Contraction and Convergence.” Their notion was to reduce overall emissions of greenhouse gases to a safe level (contraction) by leveling emissions per capita to an equal degree for all countries (convergence). The burdens of carbon taxing would fall mainly on the wealthy and profligate consumer countries, which would incentivize rapid decarbonization. C&C proposed to dispense the billions in tax revenues to bring up standards of living in the poorer two-thirds world, a sustainable development “dividend.” The UN formally adopted a version of C&C in the run-up to Kyoto (COP-3) in 1997.

At Kyoto, the UNFCCC and IPCC pushed the concept as the principle of “common but differentiated responsibilities,” an utterly ham-fisted ad slogan that obscured the whole dividend idea by appealing to moral duty rather than greed. No-one there had worked in advertising, obviously. They acknowledged that individual countries have different capabilities in combating climate change, owing to fossil-powered development, and therefore the obligation to reduce current emissions should fall most heavily on developed countries, on the basis of historical responsibility.

Al Gore was one of the white knights who brokered the final deal, bringing together the African, Indian and Chinese delegations, former Eastern Bloc countries and 36 reluctant overdeveloped (Annex I) countries, the former colonial powers and designated shame-ees. When he got home he was sent to the doghouse. It could have been worse. He might have been sent back to Harvard to study the public relations campaigns of Edward Bernays.

Faced with a divided and climate-hostile Congress that abhorred a treaty that let China and Russia off the hook for emissions reductions, President Bill Clinton declined to forward the treaty for ratification — a pocket veto of sorts. Canada, Japan, New Zealand Aotearoa and Russia later dropped out. While coal-burning countries like India and China used C&C as an excuse to dig more coal mines and burn Arabian oil, the emissions of Annex I countries also increased 32% by 2010. Kyoto was a poster child for how NOT to write climate laws.

Cap and Share

My late friend and collaborator Richard Douthwaite explained the drawbacks of C&C to me when we spoke from the same podium on my Irish tours because, while our expertise was different — he the economist and me the permaculturist — we converged on recommendations. “Cap and Share” was his invention.

My late friend and collaborator Richard Douthwaite explained the drawbacks of C&C to me when we spoke from the same podium on my Irish tours because, while our expertise was different — he the economist and me the permaculturist — we converged on recommendations. “Cap and Share” was his invention.

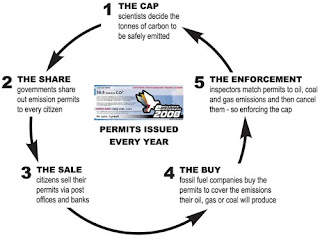

Cap and Share provided that emissions allocations be distributed equally to individuals as a common right because the atmosphere was a global commons. As a pragmatic compromise, Richard allowed a convergence period, during which the richer countries would receive higher per capita emissions allowances than poorer countries as they weaned themselves from their high living addictions. A rainy day fund would also be held back for use in countries facing exceptional difficulties, such as for Kiribati to relocate its islanders to higher ground in Australia. The system published by Feasta (the Foundation for the Economics of Sustainability, which Douthwaite founded), called for global emissions to be capped at their 2005 level and then brought down year by year at a rate fast enough to prevent catastrophic climate change.

A cap and share report, commissioned by the government of Ireland, proposed every person on Earth receive a carbon certificate representing their share of the emissions budget. They could sell their certificates to their post office or bank which could then re-sell them to oil, coal, gas, cement or steel manufacturers, or other polluters.

The similarity of this scheme to the Alaskan Permanent Fund did not escape Douthwaite and the others at Feasta. Alaska taxes its fossil miners and drillers and writes a royalty check to every resident every year. It is wildly popular and now virtually untouchable by fossil-funded state legislators and governors who would love nothing more than to raid or dissolve it.

There are some obvious flaws in Cap and Share, as there were with Contraction and Convergence. Richard Douthwaite went on to tussle with these for the remainder of his life, in The Growth Illusion: How Economic Growth Enriched the Few, Impoverished the Many and Endangered the Planet in 1992; Short Circuit in 1996, The Ecology of Money in 1999; and in 2003 he edited Before the Wells Run Dry, a study of the transition to renewable energy in the wake of climate change and peak everything.

One glaring flaw in C&S was the perverse incentive that a per capita distribution would create to make larger families and increase national populations either by fecundity or immigration. Because population size is an underlying driver of climate change, the effect of paying people or countries to have more children by issuing certificates per capita would be the same as paying them to emit more CO2.

Another flaw is the possibility of venue shopping if the agreement was not universal, not enforceable, and not equitable. Polluters would merely shop for places they can emit tax-free.

Cap and Dividend

Richard was exploring putting a sunset provision into Cap and Share and closing the venue shopping loophole when Peter Barnes, co-founder of the Working Assets Money Fund and a board member of Greenpeace introduced his Sky Trust concept. His goal was “limiting the amount of carbon that can be put into the atmosphere [by] allowing the free market to set a price on the right to emit carbon; collecting revenue from those who buy those rights; and returning earned revenue” to the commons — a la an Alaskan Permanent Fund for the world. “Sky Trust” was rebranded as “Cap and Dividend” in advance of the 2008 elections in order to raise its profile, but President Obama, advised on climate policy by Hillary Clinton, had a tin ear, choosing instead to pursue an “all of the above” energy independence strategy for the United States, tip of the hat to the Illinois coal unions down in Carbondale.

Cap and Dividend employs a gradually reducing cap on fossil use coupled with a universal benefit that would disproportionately affect people emitting more. Every month the government would send out another dividend check and people that conserve the most or produced the least pollution would get a bigger reward, or at least feel it more, than a person who has to pay higher prices refueling their Hummer or power yacht, or air conditioning their summer house in the Hamptons.

When President Cobblepot took office in 2017, several elder statesmen of the Grand Old Party called upon him to introduce cap and dividend, knowing just how good it would be for business and banking, and at the voting booths. These included former Secretaries of State James Baker and George Shultz and former Treasury Secretary Hank Paulson. The President was less interested in actually governing than golfing and his crime family was there to rake the coals at the Treasury (running up negative $4 trillion in tax breaks for the wealthy), so needless to say, anything having to do with climate change was a non-starter. Don’t let the door hit you on the way out of the Oval Office, thank you very much.

In Climate in Crisis in 1990, I wrote:

Every nation needs to put a cost on destruction of forests, topsoil and biological diversity. Every nation needs to make pollution prevention pay. But nations are afraid to act unilaterally, because to do so can place them at a competitive disadvantage. The solution is to establish world targets and provide for fair incentives to move toward them.

One way to link economic rewards for responsible climate policy would be to tie international rate of monetary exchange to protection of the environment. Nations would receive credit for strict regulation of manufacturing processes and lose credit for wastefulness and pollution. Currencies could receive value for reductions in birth rates, cessations in production of greenhouse gases, and topsoil preservation. They could lose value for use of high sulfur coal, loss of forests, or production of acid rain.

We are living wastefully, but we have been insulated from the consequences because we have begun to spend Earth’s capital as if it were income. We may not notice that we are borrowing from our children. Our children will notice.

As Edward Bernays might have told Al Gore, our evolutionary psychology inclines us away from the word “change.” We avoid pain. We seek reward, whether deserved or not — especially if not deserved. Greed trumps noble sacrifice. To ultimately succeed in reversing climate change we need to overcome normalcy bias, confirmation bias, and simplicity bias.

I, like most USAnians, will likely notice that dividend check arriving in my mailbox every month. That is how we reverse climate change. The sponsors of the bills listed at the top of this page understand that it is they who will be rewarded.

_________________

References:

Barnes, P. 2001. Who owns the sky? : our common assets and the future of capitalism. Washington, DC: Island Press. ISBN 1–55963–854–0. OCLC 46590035.

Barnes, P. 2008. Climate Solutions: A Citizen’s Guide. Chelsea Green Publishing. ISBN 978–1–60358–005–2.

Barnes, P. 2008. “Testimony of Peter Barnes to the House Ways and Means Committee” (PDF). US House of Representatives. (September 18, 2008)

Deitz, S., J. Rising, T. Stoerk and G. Wagner, 2021. Economic impacts of tipping points in the climate system. PNAS August 24, 2021 118 (34) e2103081118; https://doi.org/10.1073/pnas.2103081118

Revkin, A. 2008. “Paying the Cost of Climate Control”. NY Times Dot Earth Blog. 1/2/2008

The COVID-19 pandemic has destroyed lives, livelihoods, and economies. But it has not slowed down climate change, which presents an existential threat to all life, humans included. The warnings could not be stronger: temperatures and fires are breaking records, greenhouse gas levels keep climbing, sea level is rising, and natural disasters are upsizing.

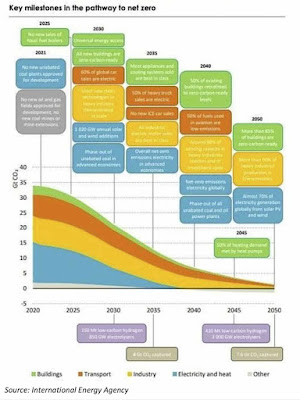

As the world confronts the pandemic and emerges into recovery, there is growing recognition that the recovery must be a pathway to a new carbon economy, one that goes beyond zero emissions and runs the industrial carbon cycle backwards — taking CO2 from the atmosphere and ocean, turning it into coal and oil, and burying it in the ground. The triple bottom line of this new economy is antifragility, regeneration, and resilience.

Help me get my blog posted every week. All Patreon donations and Blogger subscriptions are needed and welcomed. You are how we make this happen. Your contributions are being made to Global Village Institute, a tax-deductible 501(c)(3) charity. PowerUp! donors on Patreon get an autographed book off each first press run. Please help if you can.

#GenerationRestoration

“There are the good tipping points, the tipping points in public consciousness when it comes to addressing this crisis, and I think we are very close to that.”

— Climate Scientist Michael Mann, January 13, 2021.

Want to help make a difference while you shop in the Amazon app, at no extra cost to you? Simply follow the instructions below to select “Global Village Institute” as your charity and activate AmazonSmile in the app. They’ll donate a portion of your eligible purchases to us.

How it works:

1. Open the Amazon app on your phone

2. Select the main menu (=) & tap on “AmazonSmile” within Programs & Features

3. Select “Global Village Institute” as your charity

4. Follow the on-screen instructions to activate AmazonSmile in the mobile app