Illustrations by Maxime Mouysset

Jeff Carpoff was a good mechanic. But as a businessman, he struggled. In the two decades since high school, he’d lost one repair shop after another, filed for personal bankruptcy, and watched a lender foreclose on the small house in a California refinery town where he’d lived with his wife and two young kids. By 2007, he was 36, jobless, and adrift.

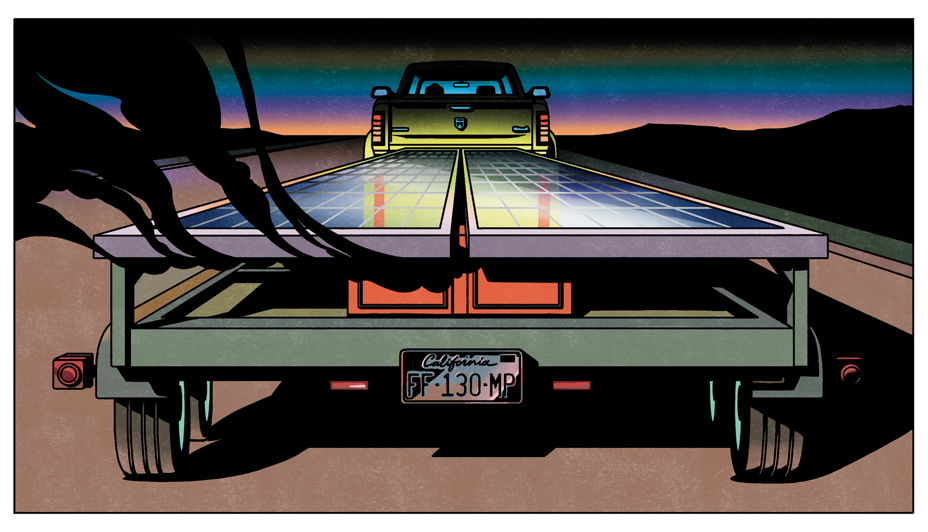

Yet there, at his life’s lowest, the remarkable happened. A contraption he’d rigged up in his driveway—a car trailer decked with solar panels and a heavy battery—got the attention of people with real money. Carpoff could scarcely have imagined it. He’d never gone to college and had no experience in green technology. His invention, he thought, was “crazy, harebrained.” But investors saw the makings of a clean-energy revolution.

For decades, there was basically one way to rush power to places without electricity: the portable diesel generator. It kept equipment running and lights on at construction sites, outdoor events, movie sets, disaster zones. But diesel generators ate the ozone layer; warmed the planet; and caused smog, acid rain, and possibly cancer, on top of their noise, smell, and fuel cost.

Carpoff’s machine—a solar generator on wheels—was a sun-fueled alternative. He called it the Solar Eclipse. The design was so simple that it was a wonder no one seemed to have thought of it before.

Carpoff was a paunchy man with blue eyes and apple cheeks—a “big chipmunk,” as a colleague called him—who gulped rather than spit his chewing tobacco and spent Sundays watching NASCAR. In March 2011, he was singing the national anthem at a local baseball game when he got a text that he’d made his first major sale: The paint company Sherwin-Williams had bought 192 of his generators, for nearly $29 million. Twenty-nine frickin’ million. It reduced him to tears.

That’s how Carpoff told the story of the day his life changed.

The millions of dollars in that first deal were like the drips before a downpour. Over the next eight years, blue-chip corporations such as U.S. Bank, Progressive Insurance, and Geico would buy thousands of Carpoff’s generators. Inc. magazine would call his company, DC Solar, a “renewable energy powerhouse” with a product “people clearly needed.” The Obama administration would make DC Solar a partner—alongside Amazon, Alphabet, and AT&T—in a national program to enlist tech in the fight against climate change.

Sales would eventually top $2.5 billion, enough for Carpoff to fly by private jet and purchase a baseball team, more than a dozen houses, and a collection of muscle cars looked after by a guy named Bubba.

Onstage at a company Christmas party, as he neared the peak of his spectacular ascent, Carpoff celebrated the way he often did: with another tequila. “Fill that fucker up,” he said as an executive poured him a glass of Herradura Silver, with a stack of limes on the side. “All the way to the top.”

Carpoff had lived almost his whole life in the small city of Martinez, on Northern California’s industrial Carquinez Strait—“the place,” he liked to joke, “where the sewer meets the sea.” His childhood home, about a mile from the city’s Shell Oil refinery, overlooked a biker bar, which Carpoff described as a hangout for marauding Hell’s Angels. “We seen things as a kid that a kid just shouldn’t see,” he recalled in footage that DC Solar’s videographer, Steve Beal, played for me. “Fights, stabbings, shootings, prostitution—all kinds of just really crazy stuff.” Jeff’s mother, Rosalie, remembered the bar as at worst a little noisy. But her son was always a storyteller, she told me, prone to embellishment “to make people feel sorry for him or laugh.”

Rosalie worked three jobs to support Jeff and his older sister. (She and his dad, Ken, divorced when Jeff was 3.) But Jeff couldn’t wait to make money of his own. As a boy, he polished used tires for 10 cents apiece, fixed junk cars, and stocked shelves at the corner liquor mart. For fun, he popped wheelies in his truck in the Alhambra High School parking lot, splattering mud on teachers’ cars.

After graduation, state officials rapped him for mishandling hazardous materials at a garage he’d opened, his father said. Jeff had a meth addiction, which made things worse, and soon he was selling the drug to pay debts to dealers, he told people. “I was getting phone calls threatening me because he owed money,” Rosalie said.

His luck seemed to turn after he married Paulette Amato, his high-school sweetheart. She had helped him get clean, and around 2002, in a little garage on a Martinez backstreet, they opened an independent repair shop called Roverland USA. Customers came from across the Bay Area for the artful shortcuts Jeff took to fix Land Rovers on the cheap.

But the business imploded after a failed expansion into retail: Cut-rate auto parts that Carpoff and a new partner had custom-ordered, in bulk, from Mexico came back so poorly machined that one of his own mechanics refused to use them. “I was here to fix cars, not break them,” Marc Angelo, who worked at the repair shop, said when I visited his garage last year. By 2007, Roverland was dead, the Carpoffs’ mortgage was in default, and creditors were suing.

Again, Carpoff tried selling drugs. He pitched his weed to a medical-marijuana dispensary in Santa Cruz, but was turned away after lab tests found his cannabis to be extremely low-grade—“full of chemicals and shit,” the dispensary’s founder told me.

That’s when a former Roverland customer called with a fateful job offer: How would Jeff like to sell solar panels?

Carpoff began talking about the gig with a neighbor, who wanted panels for his weekend house but worried they’d get stolen when he wasn’t there. Carpoff started to wonder: Did panels have to be on the roof, where thieves could snatch them? What if you bolted the panels to a trailer? That way, you could roll them into your barn or garage when you were away—or hitch them to your truck to take with you.

The title of his first patent application just about summed it up: “Trailer With Solar Panels.” Not even Carpoff was sure it made any sense.

Most people in Silicon Valley have likely never heard of Martinez, even those who speed past it on I-680 en route to Lake Tahoe. But the world’s tech capital is just an hour’s drive to the south, and the myth of it, even closer: In every Bay Area garage is a tinkerer, and behind every tinkerer’s billion-dollar idea are the discerning investors who get in first, for pennies.

Dave Watson, a software consultant and an off-roading enthusiast who’d serviced his vehicles at Roverland, had stayed in touch with its former owner. After hearing Carpoff muse about solar on wheels, Watson gathered a group of local entrepreneurs in a parking lot to see Carpoff’s odd-looking trailer.

It had potential, they thought. Its two rows of solar panels—five per row—were attached to rotating beams, a clever design that let you lock them upright for aerodynamic transport on highways, then tilt them sunward once you’d parked. This wasn’t some niche anti-theft accessory; it was an all-purpose generator, towable anywhere for green power on the go. Sales of portable generators were headed toward $3 billion a year globally, and growing fast. If you converted even some of that to solar—particularly if you were first to market—you could become very rich.

By late 2008, Watson’s associates had loaned Carpoff $368,200 and formed a company, Pure Power Distribution, to market his invention. Hollywood was a chief target. Just a year earlier, the comedy Evan Almighty had been celebrated as the first carbon-neutral production by a major studio, and Al Gore’s landmark climate-change documentary, An Inconvenient Truth, had won two Academy Awards.

Carpoff’s invention could help the entertainment industry “lead the world in making ‘sustainable’ the standard,” declared the actor Hart Bochner, who promoted the devices. (Bochner is best known for playing a coked-up businessman in Die Hard. ) They were the perfect replacement for the diesel generators that powered on-location trailers for actors and makeup artists. The base camps of a few major movies—Inception (starring Leonardo DiCaprio), Valentine’s Day (Julia Roberts), Bad Words (Jason Bateman)—were willing to give them a shot. DiCaprio, an environmentalist, posted photos on Facebook.

Carpoff, meanwhile, traveled to the motorsports mecca of Daytona Beach, Florida, where he contacted a high-end real-estate agent and presented himself as a wealthy entrepreneur in the market for a mansion (in truth, he was close to broke). Over drinks by the pool at one home, he asked her if anyone in her world might want to invest in a revolutionary solar product.

The agent thought at once of a former client named Heidi Gliboff, a well-connected businesswoman in New York. When Gliboff saw schematics for Carpoff’s generators, “fireworks were going out of my head,” Gliboff told me. The idea of making solar mobile was “so unbelievably intriguing” that Gliboff soon offered to market the devices on commission.

In September 2010, she invited Carpoff to a Long Island City hotel to meet some finance professionals. Carpoff played the underdog, telling tales about growing up in a trailer park with a mom whose Hell’s Angels boyfriend put a gun to his face. (Carpoff’s family told me that the story lacked even a kernel of truth.) If DC Solar succeeded, Carpoff swore, he’d buy them all Harleys.

One of the professionals in the room, a financial modeler named Gary Knapp, helped introduce Carpoff to the law firm Nixon Peabody, which had a well-known tax-credits practice. It was an arcane legal specialty centered on the special tax perks for industries, such as renewable power, whose growth served broader national interests.

In 2005, Congress had tripled the value of a green-energy incentive called the investment tax credit. Businesses could reduce the federal income taxes they owed by an amount equal to 30 percent of their spending on solar equipment: a 30-cent public refund for every private dollar spent. The enlarged credit led to an explosion of new solar businesses, many of which could never have started, or survived, without it. Lawyers could help companies max out the credits without running afoul of byzantine IRS rules.

Carpoff spoke with a Nixon Peabody partner named Forrest Milder, who worked in the firm’s Boston office, had degrees from Harvard and MIT, and billed nearly $900 an hour. Carpoff may have been a bit different from Milder’s usual callers, but the freewheeling car mechanic and wonky tax lawyer met at an opportune time. In 2010, with law firms struggling after the Great Recession, the head of Nixon Peabody’s tax-credits practice had begun pressing partners to “think more creatively” about their business, according to a 2012 report in The Washington Post. Tax-credits partners were urged to invent new products, ideas, and fee structures, including free legal advice aimed at hooking potential clients on their services. Partners’ ability to “innovate” factored into their pay and was “the first question” they had to answer in annual evaluations.

“It’s like investing in a start-up,” one of the firm’s tax-credits partners said of this push to lead clients, rather than to follow them. “One in 10 hits, but if it hits, it’s a big deal.” (A lawyer for Milder and Nixon Peabody said that Milder’s decision to represent DC Solar was unrelated to the innovation initiative, and that Milder’s pay was not “materially impacted” by his work for the company.)

The aggressive deals that Knapp and Milder helped design for DC Solar were as alluring as Carpoff’s solar invention. Giant corporations could decide how much they wanted to save in taxes, then—through an investment fund created just for them—buy exactly the number of generators to achieve that figure. All they’d have to put down was 30 percent of the generators’ price—the exact amount they could deduct, dollar for dollar, from their federal tax returns through the investment tax credit.

DC Solar would not only loan buyers the other 70 percent; it would pay it back for them, with the money it made leasing out generators on their behalf. Carpoff was confident enough in the rental market—DC Solar, he said, had long-term leases in the works with major telecom, entertainment, and construction companies—that he guaranteed the loan payments and promised cash payouts of leftover leasing revenue.

The upshot was that buyers could collect the tax credits and lease payments without ever having to use, maintain, or even see their own generators. The deals offered so much value, for so little down, that pitch decks advertised internal rates of return of more than 50 percent.

U.S. Bank, a famously conservative institution, was immediately interested. Sherwin-Williams, for its part, was so eager that it “seems to not care whether there is any [due] diligence,” Milder wrote to Carpoff in December 2010, in emails quoted in court documents. The “attitude has been totally unlike anything I have ever seen.”

Carpoff decided to raise prices. DC Solar, he told his advisers, should sell generators for $150,000 apiece, 50 percent more than what he’d first proposed. And within five years, he said, he could charge renters up to $1,800 a month, more than twice his initial estimate. Carpoff seemed to intuit that some buyers might actually prefer higher prices, because the steeper the sticker price, the bigger the tax credit.

Milder expressed doubts about these suddenly inflated figures. “Do you REALLY think you can rent all 192 [generators] without any ‘vacancies’ for more than double what was originally projected?” he wrote to Carpoff in March 2011, a week before the Sherwin-Williams deal closed. Carpoff didn’t answer the question. His invention, he replied to Milder, was so compelling—it “really works and pays for it self in Fuel cost”—that he believed DC Solar would get a buyout offer within a couple of years. “PS,” he added, “maybe we can have lunch soon? In the Bahamas … lol.” By the end of March, Milder was not only representing DC Solar but writing lengthy tax opinions for buyers on the legality of the deals.

Less than two months after the Sherwin-Williams deal closed, Carpoff paid $1.3 million, in cash, for a new house with a pool, a guest cottage, and garages for six cars. It was in a gated community, up a winding road, on what he bragged was Martinez’s highest hill.

That fall, a group from Sherwin-Williams was set to visit DC Solar’s production facility to inspect its purchase. Under the terms of the deal, the paint company’s generators had to be built and “placed in service” by year’s end.

As workers prepared for the inspection, a DC Solar sales executive named Brian Caffrey noticed that only the first, most visible rows of generators were fully assembled. The generators in the rows behind—some two-thirds of the total—were in various states of incompletion, though you might not notice if you didn’t know what to look for.

“Jeff, you have rows and rows of unfinished generators you’re presenting as finished,” Caffrey recalled telling Carpoff.

“You don’t worry about that,” Carpoff replied.

Caffrey angrily quit, but Carpoff had bigger problems: Almost no one, it turned out, had any real use for his generators.

One reason was that the Solar Eclipse was prone to malfunction. Carpoff had no training in solar engineering. After sketching his idea on a napkin, he’d asked Paulette’s younger brother, Bobby Amato, a former Ford auto mechanic, to build it. “I had no idea how solar worked,” Amato told me. “Good thing they got Google and all that.”

The result wasn’t bad for a couple of guys who’d never done anything like it. But it wasn’t great, either.

Power would sometimes suddenly cut out—plunging makeup trailers for Disney’s Alexander and the Terrible, Horrible, No Good, Very Bad Day into darkness, and apparently leaving Pink’s trailer without air-conditioning at an MTV concert. A group of Northern California entrepreneurs who thought the early models might aid disaster relief thought again when plugging in a single hair dryer tripped the breaker.

Carpoff began affixing 100-gallon diesel generators to the trailers as backup for breakdowns or cloudy days. But the rumble of diesel on what was supposed to be a fossil-fuel alternative made people wonder how much the planet was really benefiting. If too many weeks passed without a tune-up, generators would exhale plumes of smoke when the diesel activated. “You can imagine a solar tower with black smoke coming out of it,” the public-safety director at a university that tried them told me. “Students would sometimes say, ‘What’s going on? Is it on fire?’ and we’d have to explain that.”

There were short-term rentals: a cancer benefit, music festivals, the awards dinner for a college’s sustainability conference. But there was no market for the five-to-10-year leases that were supposed to anchor DC Solar’s business. This was no small issue. If the company didn’t have a long-term lease for each of the hundreds of generators it sold, it could neither finance buyers’ giant purchase loans nor pay returns. If generators went unused, the IRS could bar buyers from claiming the solar tax credits. And if the IRS barred the credits, DC Solar would lose the only thing anyone seemed interested in.

The Carpoffs had options, even if they weren’t ideal. They could close DC Solar. Or they could file for Chapter 11 bankruptcy, hoping that creditors would see enough worth saving to let the company reorganize.

Or maybe there was another way.

An idea took shape around June 2012, in a meeting Carpoff held with his accountant, Ronald Roach, and an individual, unnamed in court documents, who sources made clear was DC Solar’s general counsel, Ari Lauer. (Lauer didn’t respond to requests for comment.) What if DC Solar used purchase money from new buyers to pay “lease” money to earlier ones? With an accounting trick, the company could make cash from new generator sales look like lease payments from existing renters. (“Re-rent” was DC Solar’s in-house euphemism for these intracompany transfers.)

The plan had many of the hallmarks of a classic Ponzi scheme, but with a twist. DC Solar wouldn’t just defraud new buyers to pay earlier ones. By holding itself out as a legitimate solar company, it would give all of them—new and old—cover to drain millions of dollars of tax credits from the U.S. Treasury. The American taxpayer, that is, would subsidize the scam.

Carpoff would tell his inner circle it was temporary—the kind of fake-it-’til-you-make-it that every start-up dabbled in. The important thing was to keep revenue pouring into buyers’ accounts, even if it wasn’t coming from the leases DC Solar pitched as the bedrock of its business. Also important was pretending that the revenue was coming from those leases and that big companies like T-Mobile and Disney couldn’t get enough of the Solar Eclipse.

“Things are exploding here at DC Solar,” Carpoff started to say at company-wide meetings. “We’re going through the stratosphere.”

Money didn’t so much change Jeff Carpoff as give him the means to more fully be himself. He credited the American dream. “We are the land of the free,” he told his employees. “We can do anything.”

When he pulled into work in the morning, a hard-rock version of “The Star-Spangled Banner” thundered from the speakers of his red pickup truck. He later installed a massive, six-paneled photograph of the American flag on his factory walls and claimed that his family said the Pledge of Allegiance, in lieu of grace, at holiday meals.

On a trip to Las Vegas, Carpoff ordered a custom motorcycle with an “America theme” paint job. “On the tanks I want, like, the Statue of Liberty holding a flag and the flag blowing in the wind,” Carpoff told the shop’s owner, in an exchange captured in a 2012 episode of the reality-TV show Counting Cars. “I want the Constitution on the back fender.”

“We the People!” he proclaimed.

When the shop owner showed him the finished bike at the end of the episode, Carpoff, all smiles and high fives, was beside himself. “It just looks—how do I say this?—‘politically correct,’ ” he said, sending everyone there into hysterics.

If talking about cars and motorcycles came easy to Carpoff, talking about climate change did not. He often wore a pained expression as his marketing staff asked him to recite scripted lines for promotional videos.

“ ‘We strive for a healthier planet … by offering unique solar products that—’ Fuck!” Carpoff says in one of many fumbled takes. “I can’t remember. What the son of a bitch!” A shot of tequila sometimes helped.

John Miranda, a film and TV producer, joined the company as communications director because he believed in its potential to fight global warming. He began having doubts on his first day at headquarters. He’d driven into the lot to find one of Carpoff’s new muscle cars parked in a handicapped space, with a DC Solar employee changing the oil.

Carpoff, Miranda learned, was in fact a collector of vintage gas-guzzlers. His showpieces included a Dodge Charger painted like The Dukes of Hazzard ’s General Lee and a 1978 Trans Am once owned by Burt Reynolds, a replica of the one the actor had driven in Smokey and the Bandit.

No less perplexing was Carpoff’s choice of NASCAR as his main marketing partner. DC Solar spent millions sponsoring the Xfinity race series and drivers like Ross Chastain and Kyle Larson, with DC Solar’s logo splashed across cars, tracks, and racing suits. Not only was NASCAR one of the world’s most polluting sports, but the politics of its fans rarely aligned with those of the green businesses that might actually rent a solar generator. When Miranda tagged NASCAR in a DC Solar Facebook post, one of the first replies was “Solar is for fags.”

If employees asked questions, Paulette, a small but commanding woman, had a stock retort: Stay in your lane. She had grown irritable and hypervigilant, liable to explode at the least provocation.

Jeff, meanwhile, looked like he was having an enormous amount of fun. A sign he’d make for his office parking space bore the letters JMFC. It was the acronym for the nickname he’d given himself: Jeff “Mother Fuckin’ ” Carpoff. (He extended the honorific to Paulette and their kids, Lauren and Matt, whose parking spaces were marked PMFC, LMFC, and MMFC.)

It was hard to fault his confidence. In less than three years, he’d sold nearly 1,200 generators, for $174 million. Yet if you stopped by the company’s small headquarters—near a water-treatment plant in Concord, California—you might never guess at the torrents of money sloshing through its accounts.

Forrest Milder seemed taken aback by how fast the IRS had moved. “An audit from the IRS?” the tax lawyer wrote to Carpoff in July 2013 after learning that the Sherwin-Williams deal was under review. “Is this even old enough to be audited?”

As Milder worked to fend off an apparently deepening IRS investigation, Carpoff faced a more immediate threat. In February 2014, an alarming email had arrived from James Howard Jr., an investment executive who was helping Valley National Bank purchase $76.8 million worth of Carpoff’s generators.

Carpoff had told Howard that 80 to 90 percent of DC Solar’s generators were rented out. But Howard was demanding proof, and company executives knew they couldn’t provide it. A list of actual leases would reveal a minuscule 5 percent leasing rate, which would imperil the Valley National Bank deals and expose the Ponzi scheme.

A DC Solar lawyer—who court documents indicate is Ari Lauer—deflected by claiming that most lease information was confidential. But Howard refused to be put off. So Ronald Roach, the DC Solar accountant, leaned on a colleague named Rob Karmann.

Karmann was a former high-school classmate of Roach’s who struggled with alcohol abuse and had been fired from several jobs before calling Roach in search of work. This call led, however implausibly, to a job at DC Solar, first as controller, then as chief financial officer. Over four years, Karmann’s salary, with bonuses, would grow from $135,000 to $475,000, plus a company car and a golf membership.

Enjoying a sense of what an associate called “respectability” for the first time in his life, Karmann obligingly produced fictitious reports of who was leasing the units and for how much. (“This guy gets his shit done” was how Carpoff toasted him at one holiday party.) Karmann’s newfound social status was “probably the biggest reason … I was so willing to go along with stuff I should have walked away from,” he told me this past September, by phone from federal prison.

(Valley National Bank and Progressive Insurance did not respond to requests for comment. A U.S. Bank spokesperson told me, “While we conduct due diligence and review the business plans of companies we invest in, it’s not possible to know how individuals operating these companies will act in future periods.” Messages left for Gary Knapp, the financial modeler—and his son Nicholas Knapp, who would become one of DC Solar’s most prolific outside brokers—were not returned.)

Carpoff needed each new deal to be bigger than the last. He had no other way to cover the mushrooming “lease” payments (he told a colleague they were “killing” him, according to court documents), or the high-flying lifestyle that advertised his success. But investors were no longer taking it on faith that leases existed. Carpoff needed real—or at least real-looking—leases to show around, ideally from big-name brands.

Around September 2015, Carpoff approached his vice president of operations, Ryan Guidry, a Louisianan who’d had a long career as a bartender before marketing what an associate said were subprime loans in the lead-up to the 2008 mortgage crisis. Could Guidry find someone to sign a fake T-Mobile lease? Carpoff asked. A phony contract that committed “T-Mobile” to leasing 1,000 generators for at least a decade, at $13 million a year?

Carpoff said he’d pay $1 million to Guidry and $1 million more to whoever signed as “T-Mobile.”

Guidry thought of Alan Hansen, a local T-Mobile employee who had powered some San Francisco cell towers with rented Solar Eclipses during blackouts. Guidry invited Hansen to a bar, bought him a couple of beers, and put the forged lease in front of him, Hansen told me. (Neither Guidry nor his representatives responded to requests for comment.)

Hansen, a middle-aged Navy veteran frustrated by his failure to advance at T-Mobile, accepted the $1 million and signed the contract, deliberately not reading it. Carpoff then hired Hansen at a salary 60 percent higher than what he’d made at T-Mobile and gave him a do‑nothing job. Around DC Solar’s offices, Hansen carried himself with an air of dignity and spoke of once wanting to be a minister.

The following year, at the NASCAR season opener known as Speedweeks, Carpoff befriended Frank Kelleher, the managing director of International Speedway Corporation (ISC), which ran the Daytona International Speedway and other major NASCAR tracks.

Within months, ISC signed contracts to lease 1,500 generators for 10 years, at a cost of $150 million, according to court filings. But the contracts—marked “NON-CANCELLABLE” and “UNCONDITIONAL”—had an undisclosed addendum that gave DC Solar and ISC multiple outs. (NASCAR, which acquired ISC in 2019, did not respond to requests for comment.) Over about two years, ISC would pay DC Solar $8.5 million for its leases—and get $15 million in “sponsorship payments” from DC Solar. In an internal email from 2017, ISC’s CFO called it “a mutually beneficial relationship.”

The “T-Mobile” and ISC leases came together as DC Solar courted a whale. The insurance company Geico was owned by Berkshire Hathaway. Warren Buffett’s conglomerate was a seasoned user of tax credits and the fourth-largest company on the Fortune 500.

Buffett was bullish on solar. “If somebody walks in with a solar project tomorrow and it takes a billion dollars or it takes $3 billion, we’re ready to do it,” he would later say, at a 2017 shareholders’ meeting. “And the more the better.”

But DC Solar spooked Geico two weeks before the deal was to close, by asking for faster payments—supposedly to fix some supply-chain snag. Geico’s CFO, Mike Campbell, found the last-minute upsell “very troubling.” “It makes me wonder about their financial backing … and whether they can handle the volume of deals they are trying to put together,” Campbell wrote to a subordinate. “If there’s a way out of the deal, take it.”

DC Solar raced to pacify Campbell. The deal was salvaged. In four transactions over three years, Geico would buy 7,980 generators for nearly $1.2 billion, saving the company some $377 million in taxes. (A lawyer for Geico declined to say whether Buffett had played any role in the deal. A Berkshire spokesperson didn’t respond to messages.)

Flush with Geico’s money, DC Solar moved its headquarters, in the summer of 2016, from a back road in Concord to a modern hilltop facility 10 miles north, in Benicia, overlooking the rush of commuters on I-680.

Inspired by the shop floors at Chip Ganassi Racing, a prestigious racing organization whose NASCAR drivers DC Solar sponsored, Carpoff bought a Zamboni to keep his factory floor gleaming.

“When … the bankers come in,” Carpoff explained to a visitor, in a conversation captured by Steve Beal, DC Solar’s videographer, “they see this, and it’s automatically a great first impression.”

Impressions mattered more than ever, because within months of the move, DC Solar had all but stopped manufacturing Solar Eclipses—even as it sold record numbers of the devices. If you could fool smart businesspeople with fake leases, how much harder could it be to sell them fake generators? The very thing that had wowed early investors—the generators’ portability—made their absence from any particular location easy to explain away. “Here one day, there the next” had basically been the sales pitch.

To prove that the generators were somewhere, DC Solar had begun sending buyers “commissioning reports,” with a DMV-registered vehicle identification number and 20-point physical inspection for each unit. The “independent engineer” who produced these reports was not independent and not an engineer. Joseph Bayliss was a classmate of Carpoff’s from high-school auto shop, another “mope”—as an associate called him—with an inflated job title. “Never says no,” Carpoff said of Bayliss, in a tribute at a holiday party.

Carpoff employed a different tactic with buyers who insisted on counting their generators in person at DC Solar’s warehouses. He and his workers used putty knives, acetone, and mineral spirits to remove VIN stickers from generators belonging to earlier buyers, then applied, to those same units, the VINs of whatever buyer happened to be visiting. To dupe buyers who wanted real-time data on their units’ whereabouts, workers buried GPS transponders in out-of-the-way locations, minus the generators they were billed as being attached to.

Inspectors willing to drive hours to see their Solar Eclipses in the field were the hardest to misdirect. Carpoff had employees work overnight, delivering generators in the nick of time, to make it look like they’d been there all along.

Of the more than 17,000 generators sold from 2011 to 2018, only about 6,000 would be found to exist.

By 2016, the IRS had begun to catch on. The agency had examined DC Solar’s first two deals: the one with Sherwin-Williams, and another with a specially formed company called Aaron Burr LLC, an apparent allusion to the man who killed Alexander Hamilton, the first Treasury secretary, in a duel.

IRS investigators concluded that the fair market value of each Solar Eclipse—if manufactured in the quantities claimed—was, with a reasonable markup, about $13,000. That was less than one-tenth of the $150,000 that DC Solar charged buyers. And that meant that the $45,000 buyers saved on their taxes for each generator was more than 300 percent of its value, instead of the 30 percent federal law allowed. It also meant that even if DC Solar never earned a cent from leases, buyers’ 30 percent down covered all the manufacturing costs, thrice over.

In addition, the IRS found, Sherwin-Williams and Aaron Burr were so insulated from risk that they were ineligible for most or all of the tax credits—and subject to penalties. DC Solar’s transaction structure, IRS investigators alleged, was a “sham” involving “a mere circular movement of money … to prop up a vastly overstated purchase price in order to impermissibly maximize the energy credit.”(In a statement to The Atlantic, Sherwin-Williams said that it relied, for due diligence, on “purported experts” in renewable-energy tax credits, and cautioned against “blaming the victims rather than the professionals who enabled this fraud.” Aaron Burr LLC did not respond to requests for comment.)

It was a damning allegation, but audit reports are confidential, leaving other investors in the dark.

In June 2016, around the time the IRS sent its findings to DC Solar, Transportation Secretary Anthony Foxx chose the company as a partner in the Obama administration’s Smart City Challenge, which pressed cities to adopt climate-friendly technology. The selection put DC Solar in the company of far better-known partners, including Amazon Web Services, Alphabet’s Sidewalk Labs, and Microsoft co-founder Paul Allen’s Vulcan Inc., all of which promised to supply the winning city with technology and support.

When the Obama administration chose Columbus, Ohio, as its winning Smart City, the fact sheet citing DC Solar’s pledge—of $1.5 million in solar gear—came straight from the White House.

“We are now partners of the United States,” Dan Briggs, an executive with DC Solar’s charitable arm, who’d once run for a Nevada-state-assembly seat, boasted in an interview for a company holiday video. “We are recognized by the top people in government as being a go-to operator to help them get things done.

“Where this takes us in the future,” Briggs added, shaking his head, “is limitless.”

Back home in Martinez, the mayor and city council celebrated the Carpoffs as hometown heroes. The couple sponsored a holiday ice rink, donated $100,000 to the police, and bought the city a professional independent-league baseball team, the Martinez Clippers.

But they spent much more on themselves: cars; couture; homes in Cabo San Lucas and Las Vegas; a luxury box at the Raiders’ new NFL stadium; extravagant Christmas parties at San Francisco’s Fairmont Hotel, where DC Solar’s workers—just 100 or so at the company’s peak—were treated to private performances by the pop band Sugar Ray, the rapper Pitbull, and the country duo Big & Rich.

Hardly a day went by when Carpoff wasn’t cooking up a new business idea, whether it was starting a bottled-water brand, producing a Sasquatch movie, or supplying light towers for President Donald Trump’s border wall, according to a senior employee, who called his boss “Willy Wonka.” Carpoff was already leasing warehouses to marijuana growers, one of whom was paying rent in $250,000 cash installments, he told associates.

At DC Solar’s 2017 holiday party, an executive named Mark Hughes lionized Carpoff as an epoch-making inventor. “The Thomas Edison of the West Coast,” Hughes said from the ballroom stage.

When Carpoff got to the lectern, he assessed himself differently. “I’m kind of entrepreneur,” he joked. “More manure than entre.”

To judge by the weak laughter, few in the audience found it funny. It cut too close, perhaps, to what many of them already suspected. The record-breaking sales in 2017—the more than 5,100 generators, for more than $748 million? It baffled the workers who knew how few were being built. “How is the company surviving?” Jason Rieger, a technician, recalled wondering. Accounting employees didn’t know what to think when Carpoff swaggered through the office with shopping bags stuffed with cash.

The Carpoffs had by then installed dozens of surveillance cameras around the offices and shop floor. Paulette scrutinized the feeds, which played on a large TV screen in her office, and barred workers from going alone into the file room, where contracts, invoices, and VIN registrations were stored. She interrogated an employee who made frequent bathroom trips and fired another for cc’ing a co-worker’s personal email rather than his company address. Two large dogs, Belgian Malinois named Diesel and Fou—the latter trained to attack—followed her everywhere. A plaque on her desk, one employee recalled, said I’ll be nicer if you’ll be smarter.

The fear Paulette inspired gave Jeff the slack to play the boss you felt lucky to have. At the end of all-hands meetings, he would pull hundreds of dollars from his pocket and give it to whichever employee best guessed its sum.

But the acts of generosity had started to feel performative. The Carpoffs had millions of dollars for over-the-top holiday parties but resisted better medical benefits for workers. “We all bit that fucking hook,” Bobby Amato, Paulette’s brother, told me, still bitter about Carpoff’s failures to credit him for co-inventing the generator. “[Jeff] said, ‘One day, we’re all going to be rich.’ I said, ‘I don’t see nobody being rich here but you.’ ”

Toughest to manipulate were the people who needed neither money nor approval: the professional dealmakers and investors who’d learned things about DC Solar that could destroy the company. On at least three such people, sources told me, Carpoff tried intimidation—summoning a burly Polish émigré, a reputed loan shark whom Carpoff alternately described as an experienced killer, a prison-camp survivor, and a mafioso.

An early investor who’d grown suspicious of Carpoff cut off all contact after a couple of encounters with the Pole, who the investor believes put a tracking device on his truck. “When I saw his ‘Polish Mafia’ come in, that was it,” the investor told me.

Whether the Polish man was a true thug or a wannabe is unclear. But Carpoff was an illusionist: It mattered less whether people were in actual danger—or on the brink of great wealth—than that they believed themselves to be.

At about 8 o’clock one weeknight around February 2018, Mimi Morales, who served as both cleaning lady and limo driver for the Carpoffs, noticed something amiss while vacuuming the offices: An employee named Sebastian Jano had used a back entrance and was coolly packing up his desk.

Jano, a solar-financing expert with law and business degrees from Villanova, was a new recruit. Carpoff had hired him the year before to solicit deals.

Morales asked Jano where he was going.

Jano replied that he’d gotten an offer from another company.

“He acted totally normal,” Morales told me. “No big deal. ‘Just getting my stuff.’ ”

DC Solar’s headquarters were already a paranoid place. But after Jano’s departure, workers noticed more paper-shredding and more closed-door meetings, and were no longer allowed to open mail.

The Carpoffs had secretly moved millions of dollars to offshore accounts in the Bahamas and the Cook Islands. In August, they bought a $5 million house in the Caribbean nation of St. Kitts and Nevis and applied for a government program there that supplies passports and citizenship to buyers of luxury homes.

Beal, the videographer, was putting together a celebratory film for the company’s 2018 Christmas party when he stopped by Carpoff’s office that fall. On the desk was what Beal described to me as a “holy-shit amount of money”: cliffs of cash so tall that people sitting on opposite sides wouldn’t have been able to see each other.

In early December, the Carpoffs told their office manager, Brian Strickland, that they were going on an unplanned vacation. They needed him to take photos for new passports, which someone was helping fast-track.

“They seemed in a rush,” Strickland told me. “The way they said it was ‘We have this guy who’s going to do it for us super quick.’ ”

On Tuesday, December 18, 2018, some 175 federal agents, supervised by the FBI’s Sacramento office, began streaming in unmarked cars toward Benicia and Martinez. Joining the bureau were agents with IRS Criminal Investigation and the U.S. Marshals Service.

At about 9:30 a.m., the agents swarmed DC Solar headquarters, while a SWAT team broke down the front door of the Carpoffs’ hillside home. Agents found nearly $1.7 million in cash in Carpoff’s office safe.

The agents pressed employees for the location of his cars. They were pointed down the street, to a trio of pristinely maintained warehouses. Inside was a museumlike collection that favored the American muscle car but spanned almost the entire history of the automobile, from a 1926 Ford Model T to a 2014 Tesla Model S—nearly 150 cars in all, beautiful to look at, but so battery-dead that U.S. Marshals couldn’t get many of them to start.

While the raids were under way, Carpoff called the office to ask if his and Paulette’s passports were still on his desk. Told no—agents had seized them—Carpoff said, “Oh fuck” and hung up.

It’s hard to know why he didn’t flee earlier. He had told a colleague that he was scared of flying over oceans. But another fear may have been stronger: Running would destroy the fantasy that had turned him from local screwup into local hotshot. Just three days before the raids, he was wearing black sequins and partying with Pitbull at the DC Solar holiday party, as if being Jeff “Mother Fuckin’ ” Carpoff for one more night trumped the grubby unknowns of a lifetime on the run.

Whether or not Carpoff knew it, his fantasy had begun to unravel about 10 months earlier, when the Securities and Exchange Commission received a whistleblower report from an employee who’d recently resigned. Court documents strongly suggest—and multiple sources confirmed—that the employee was Sebastian Jano, who’d startled the cleaning lady the night he left. (Jano did not respond to requests for comment.) According to court filings, the employee discovered the circular payments and confronted Carpoff and Lauer, DC Solar’s general counsel. Unmoved by Lauer’s alleged claim that there was a “method to the madness,” the employee quit. The SEC alerted the U.S. Attorney’s Office for the Eastern District of California, in Sacramento, which called in the FBI.

As agents seized cars and other assets that December day, Carpoff arranged for a Louis Vuitton bag stuffed with a men’s Cartier watch and as much as $640,000 in cash to be handed off—at a Las Vegas bar called Timbers—to a friend who’d trained the Carpoffs’ Belgian Malinois, the friend alleged in a lawsuit. (Carpoff had previously assured confidantes that he’d planned for contingencies. “He said, ‘I still have $500,000 worth of meth buried in a cemetery in Martinez,’ ” Morales told me. “He said, ‘That’s my emergency parachute.’ ”)

The next night, or the one after, Carpoff asked Bayliss—the high-school classmate who’d signed the fake commissioning reports—to meet in the parking lot of a Martinez Burger King. Carpoff told him to get a burner phone, travel to a Las Vegas warehouse, and trash the hundreds of fraudulent VIN stickers the company stored there. Bayliss, toasted as the guy who “never says no,” did as he was told.

As federal agents closed in, Carpoff told Bayliss to keep cool. If no one talked, Carpoff said, according to Bayliss, the government would have nothing to go on. But Bayliss sensed that the feds weren’t “that stupid,” according to an IRS memo of his interviews with investigators. And he finally said no. His meetings with federal agents and assistant U.S. attorneys in July 2019, and his agreement to plead guilty, all but gave the government its other targets. Over the next few months, prosecutors secured guilty pleas and cooperation from Roach, DC Solar’s accountant; Karmann, the CFO; and Guidry, the VP of operations. Hansen, who was paid $1 million for signing the fake T-Mobile lease, would admit his guilt a little later. All have been sentenced to prison, or are expected to be by the end of this year. (This past September, the SEC filed a civil lawsuit charging Lauer, DC Solar’s general counsel, with securities fraud. Lauer has filed a motion to dismiss, saying he violated no laws.)

The Carpoffs were cornered. Stripped of wealth—and of their lieutenants’ loyalty—they pleaded guilty on January 24, 2020: Carpoff to money laundering and conspiracy to commit wire fraud, Paulette to money laundering and conspiracy to commit an offense against the United States. (The Carpoffs declined multiple interview requests for this story.)

Over eight years, in at least 34 deals, DC Solar had defrauded more than a dozen corporate customers out of almost $1 billion. Because those corporations had used the investment tax credit to deduct roughly that entire sum from their taxes, DC Solar had effectively robbed the American people. The corporations are expected to return their ill-gotten tax breaks to the U.S. Treasury. Most of them joined a 2019 lawsuit accusing more than a dozen of DC Solar’s legal and financial advisers—including Nixon Peabody and Milder—of negligence, malpractice, and fraud.

The lawyer for Milder and Nixon Peabody wrote to me that neither Milder nor the firm were aware of or complicit in any criminal fraud. Nixon Peabody, the lawyer said, served solely as tax counsel, providing opinions based on “an assumed set of facts” that were only later exposed as false or fraudulent. The lawyer added that the investors had access to at least as much information about the company’s performance. Though they deny any wrongdoing, Milder and Nixon Peabody agreed last year to pay the plaintiffs what court filings describe as a “substantial” undisclosed sum, a settlement larger than those paid, to date, by any of DC Solar’s other advisers.

[Read: The Solyndra scandal: What it is and why it matters]

Carpoff’s $1 billion Ponzi scheme was smaller, in dollars, than Bernie Madoff’s (about $19 billion) or R. Allen Stanford’s (about $7 billion). But it was nearly twice the size of the 21st century’s best-known green-energy scandal: the one involving Solyndra, the politically connected solar-panel company, based just 45 miles south of Martinez, that got a $535 million federal loan guarantee in 2009, only to go bankrupt two years later. It’s hard to think of another 10-figure fraud—in any sector—that rooked so many banks, insurance companies, and other sophisticated financiers. It’s harder still to conjure a billion-dollar swindle in which some of the nation’s top financial companies were outmaneuvered on their own turf by a high-school-educated, small-town mechanic.

Jeff Carpoff is serving his time in a medium-security correctional institution in Victorville, in a sun-scorched patch of California’s High Desert.

At his sentencing, on November 9, 2021, in a federal courthouse in Sacramento, he apologized to the government, investors, and his family. But his lawyer, Malcolm Segal, said that other people, who had not been charged, shared responsibility: The professional advisers who gave the deals the sheen of legitimacy. The brokers who got six-figure commissions for bringing buyers to the table. The buyers themselves, who vetted the transactions with teams of experts yet returned to DC Solar for one multimillion-dollar deal after the next.

When the judge, John Mendez, asked Carpoff if he had anything to add, Carpoff said, “Yeah.”

He claimed that he’d never had the brains for a tax-credit deal. He’d trusted the wrong people. He would have quit long ago had buyers cared about anything but their tax credits. “The bigger the deal, the easier they were to close,” Carpoff said. “It was the most bizarre thing.”

Then he told the judge that in 2018—the year of the FBI raid—he’d been on the cusp of finally setting things right. DC Solar had an offer for 30 leases from a sports-marketing company. It had a signed contract to provide 10,000 car chargers to the U.S. Department of Transportation for parking lots and schools across the country. (A DOT spokesperson told me there was never any such contract.)

When Carpoff started talking about new marketing plans for solar generators with video screens and facial-recognition software, Judge Mendez cut him off. “You were selling air,” the judge said. He sentenced Carpoff to 30 years in prison. Seven months later, Paulette, deemed less culpable, would be sentenced to 11 years and three months.

At a DC Solar holiday party a few years earlier, after a little tequila, Carpoff gleefully told the story of one of his first encounters with the law. He was 15 and had persuaded his high-school auto-shop teacher to sell him a 1970 Chevelle—even though Carpoff had no license, no insurance, and no registration. He’d driven it for less than a day when a highway patrolman gave him a ticket and ordered him to walk home.

Three decades later, the story still resonated enough for him to want to share it with a banquet hall full of investors and employees. During that glorious ride, in that exhilarating stretch before anyone realized how many laws he was breaking, “I said, ‘Man, I got away with this,’ ” he reminisced. “I’m like, ‘Man, look at me.’ ”

This article appears in the June 2023 print edition with the headline “Burned.”